For years, Nigerian freelancers, creatives, and remote workers operated in a grey zone. However, from January 1, 2026, Nigeria tax laws for freelancers will bring freelancers, creatives, and remote workers into the tax system.

Unlike before, where you earned in dollars or pounds, received payments through Wise, Payoneer, crypto, or direct bank transfers, and quietly managed your money on your own, that informal era is ending. Now, if you live in Nigeria and earn independently (locally or globally), the law treats you as a taxable economic participant.

How does this work? What part of your income gets taxed? What are the best steps to take to be prepared? Here are your answers.

READ ALSO: Nigeria New Tax Laws Explained: What Changes in 2026 and Why It Matters?

Are You Taxable?

You are considered a tax resident if you live in Nigeria, maintain a home here, or spend 183 days or more in the country within a year. That means global income is taxable in Nigeria, regardless of where your clients are based.

This applies whether you are a graphic designer, developer, content creator, videographer, digital marketer, or a remote employee earning foreign currency. Even if your final tax bill is zero, filing a return is mandatory.

How Does the Government Identify Your Income?

A major concern among freelancers is how the government knows what you earn. The law does not tax every bank transaction. Instead, income is identified through self-assessment filings, bank inflow patterns flagged during audits, payment platform records when requested legally, contracts, invoices, or payment proofs you submit.

The burden is on you to declare your income accurately, not on the bank to guess.

Will the Government Deduct Tax Directly From Your Bank?

No, your tax will not be deducted automatically from every transaction.

Nigeria operates a self-assessment system, not an automatic withholding model for freelancers. Banks do not deduct personal income tax from your account unless a court order exists, or you fail to pay assessed tax after enforcement begins.

What the tax authorities expect is annual filing, clear records, and timely payment.

How is Your Tax Calculated?

You are taxed on profit, not revenue. For example: If Tunde earns ₦300,000 monthly from freelance video editing but spends ₦80,000 on data, power, software, and equipment upkeep, his taxable income is ₦220,000, not ₦300,000.

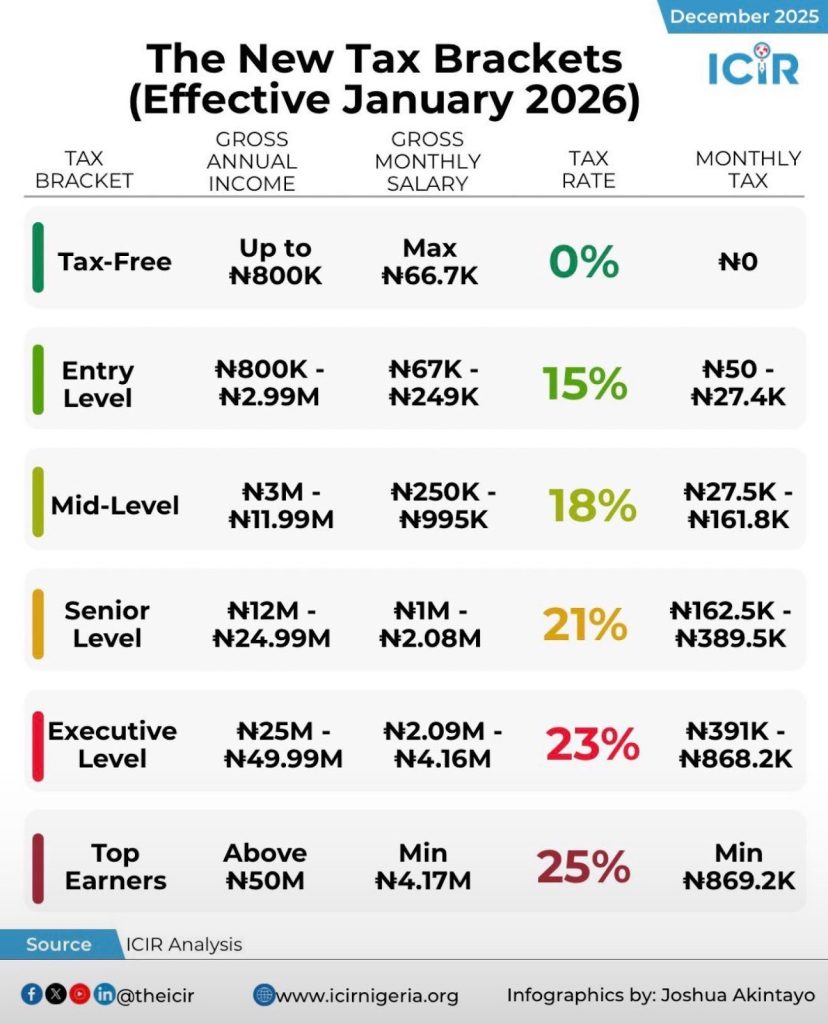

If his annual taxable income is ₦800,000 or less, he pays zero income tax. Above that, progressive tax rates apply, rising gradually up to 25% for high earners.

In Tunde’s case, he would earn ₦3,600,000 in a year, and he would pay 18% on that income, which would be ₦648,000.

What Expenses Can You Deduct?

Allowable deductions include:

- internet and data,

- software subscriptions,

- laptops, cameras, and repairs,

- electricity or fuel,

- transport for work,

- training and certifications,

- work-specific clothing or equipment (if provable),

- up to 20% of rent paid (max ₦500,000).

If you would spend the money without your work, it likely doesn’t qualify.

Foreign Clients and Double Taxation

If tax has already been deducted abroad or by your companies, Nigeria allows foreign tax credits, provided you can show proof. Nigeria also has double taxation treaties with 15 countries. These countries include Belgium, Canada, China, the Czech Republic, France, the Netherlands, Pakistan, the Philippines, Romania, Singapore, Slovakia, South Africa, Spain, Sweden, and the United Kingdom.

What You Must Do Before 2026

- Register with your state tax authority

- Keep income and expense records

- Convert foreign earnings using CBN rates

- File returns by March 31 annually

- Set aside 10–15% of profit monthly

The Bottom Line

These Nigeria tax laws for freelancers, remote workers, and creatives will mean a new era begins next year. The safest move is for you to get organised now before enforcement begins in 2026. Prepared freelancers will pay less, while unprepared freelancers will pay penalties.