If you are struggling to pay your school fees or take care of yourself while in school, there is a loan that the Nigerian government has launched to help students just like you.

NELFUND (Nigerian Education Loan Fund) provides financial support to cover school fees and upkeep so that students can focus on learning instead of worrying about money.

Whether you’re in a federal, state, or private university, you are eligible for NELFUND.

ALSO READ: The Best Private University in West Africa: How Much Does It Really Cost?

What Is NELFUND?

NELFUND provides interest-free loans to eligible students to cover tuition and monthly upkeep.

Higher education in Nigeria is expensive, and these costs add up quickly. Because of this, the Managing Director and Chief Executive Officer of the Nigerian Education Loan Fund, Akintunde Sawyerr, has urged Nigerian youths to take full advantage of the student loan scheme.

According to him, accessing the loan can help young people build a strong future for themselves while also supporting the development of the country.

Since the launch of the scheme in May 2024, Sawyerr revealed that the Fund has disbursed ₦174 billion to over 800,000 students across about 263 tertiary institutions nationwide.

Who Can Apply

To qualify for a NELFUND loan, you must:

- Be a Nigerian citizen

- Be enrolled in a federal, state, or private university/polytechnic/college

- Be registered with JAMB

- Have an NIN and BVN

- Prove your admission and student status

- Show evidence of financial need

Your school must appear on NELFUND’s list of approved institutions, and over 240 schools already participate in the scheme.

How to Apply For NELFUND: Step by Step

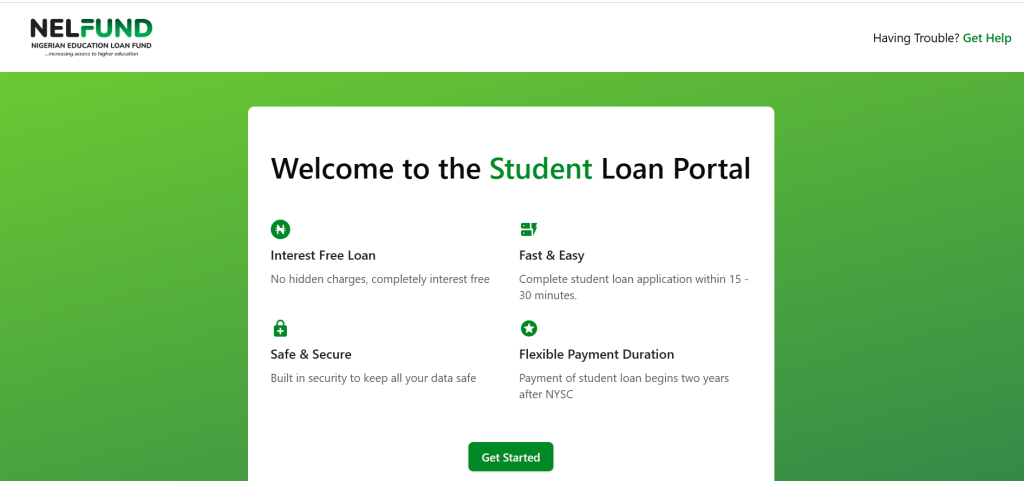

1. Visit the NELFUND Portal

Go to www.nelf.gov.ng.

2. Click on Apply Now

Scroll down to the bottom of the page and click “Apply Now” → “Get Started.”

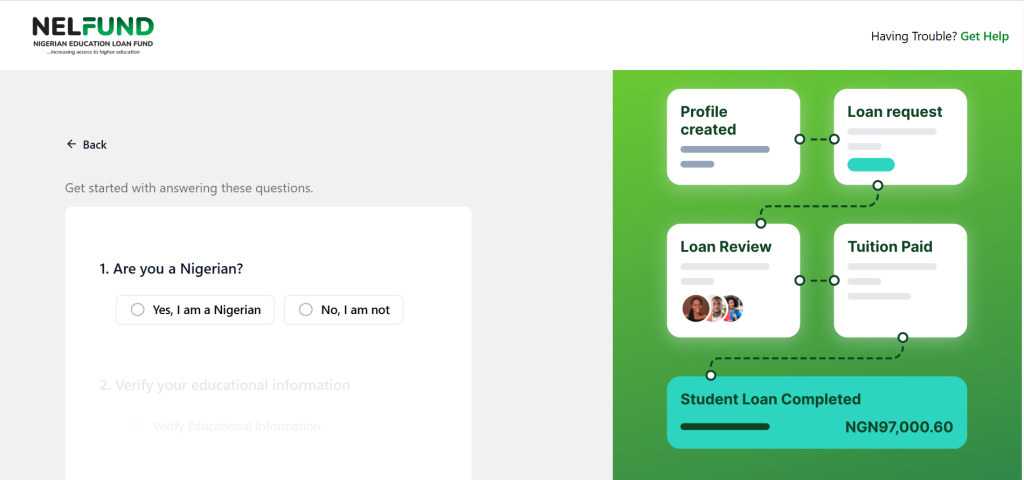

3. Verify Your Identity

Confirm you are Nigerian, enter your NIN and BVN, and the system will auto-fill your details.

4. Add Your School Information

Include your institution name, admission number, JAMB number, student ID, admission letter, and possibly your school fees invoice.

5. Agree to Loan Terms

Accept the GSI (Global Standing Instruction), which allows repayment to be deducted automatically once you graduate and start working. Review and submit your application.

6. Track Your Application

Log in anytime to check status. If approved, disbursement occurs within 30 days.

Important Updates To Note

- Disbursements now follow each institution’s academic calendar, so students receive upkeep payments only while their session is active.

- Once the session ends, payments stop automatically. Students must reapply at the beginning of a new academic year to access upkeep loans and institutional charges for the next session.

- NELFUND has improved its online portal to display only upkeep loans for the current session. Institutions are also required to upload their academic calendars promptly to prevent delays in disbursement.

What the Loan Covers

The NELFUND loan comes in two parts:

- Tuition Fees: Paid directly to your school

- Upkeep Allowance: Up to ₦20,000 monthly, sent to your account

This support helps with food, bills, and daily expenses, so you won’t have to rely entirely on family or part-time work.

RELATED: JAMB Releases 2026 UTME Registration Guidelines — Everything You Need to Know

NELFUND Loan Repayment

President Bola Tinubu’s Special Assistant on Social Media, Dada Olusegun, has clarified that no NELFUND beneficiary has started repaying their loan.

He explained that repayment will only begin two years after a beneficiary completes the National Youth Service Corps (NYSC).

In addition, NELFUND Managing Director Akintunde Sawyerr described the repayment system as seamless, transparent, and fair.

According to him, the structure ensures that graduates are not frustrated or financially burdened as they transition into life after school.

YOU MIGHT LIKE: This African Country Pays Students to Go to University

Frequently Asked Questions (FAQs) About NELFUND

1. Is NELFUND real?

Yes, it is real. Over ₦174bn has been disbursed to over 800,000 beneficiaries from about 263 tertiary institutions.

2. Has repayment started for any student?

No. As of January 2026, no beneficiary has reached the repayment stage.

3. When will I start repaying my NELFUND loan?

Repayment will begin two years after you complete NYSC, not immediately after graduation.

4. Will I be arrested or restricted from travelling if I don’t repay?

No. NELFUND has confirmed that the loan does not come with any travel ban.

5. How will repayment be collected?

Employers handle repayments through salary deductions once beneficiaries secure gainful employment, while NELFUND uses the GSI system only to recover funds from individuals who deliberately try to avoid repayment.

6. Does the loan attract interest?

No. The NELFUND loan is interest-free.

7. Can private university students apply?

Yes. Students in federal, state, and private institutions can apply, as long as their school is approved.

8. Do I need to reapply every year?

Yes. Under the new guidelines, students must reapply at the beginning of each academic session for both tuition and upkeep loans.