Last week, the Federal Inland Revenue Service (FIRS) signed a Memorandum of Understanding (MoU) with France’s tax authority, the Direction Générale des Finances Publiques (DGFiP), at the French Embassy in Abuja.

The agreement was signed by the FIRS Executive Chairman, Dr Zacch Adedeji, and the French Ambassador, Marc Fonbaustier, marking a new phase in Nigeria’s push to modernise tax administration.

What the FIRS–France Tax Partnership MoU Is About?

At its core, the partnership is a technical cooperation framework. According to FIRS, the MoU focuses on strengthening tax administration, improving digital processes, building staff capacity, and adopting global best practices in compliance, audits, and policy design.

France’s DGFiP is one of the world’s most advanced tax authorities, with over a century of institutional experience and a workforce of more than 90,000 professionals. FIRS says the deal allows Nigeria to learn from that experience, especially as it transitions into the proposed Nigeria Revenue Service (NRS).

READ ALSO: CBN Releases Full List of 82 Licensed BDC Operators — Here’s What Changed

Why the Deal Raised Controversy

Critics, including opposition figures and policy commentators, raised alarms over data security and national sovereignty.

Concerns centred on whether the agreement could expose Nigeria’s sensitive economic data or give France undue insight into the country’s fiscal systems. This concern comes especially amid France’s shifting role in West Africa.

Some critics described the deal as potentially handing France a “dashboard” into Nigeria’s economy, warning that even aggregated data could reveal strategic financial patterns.

FIRS’ Response to the Backlash

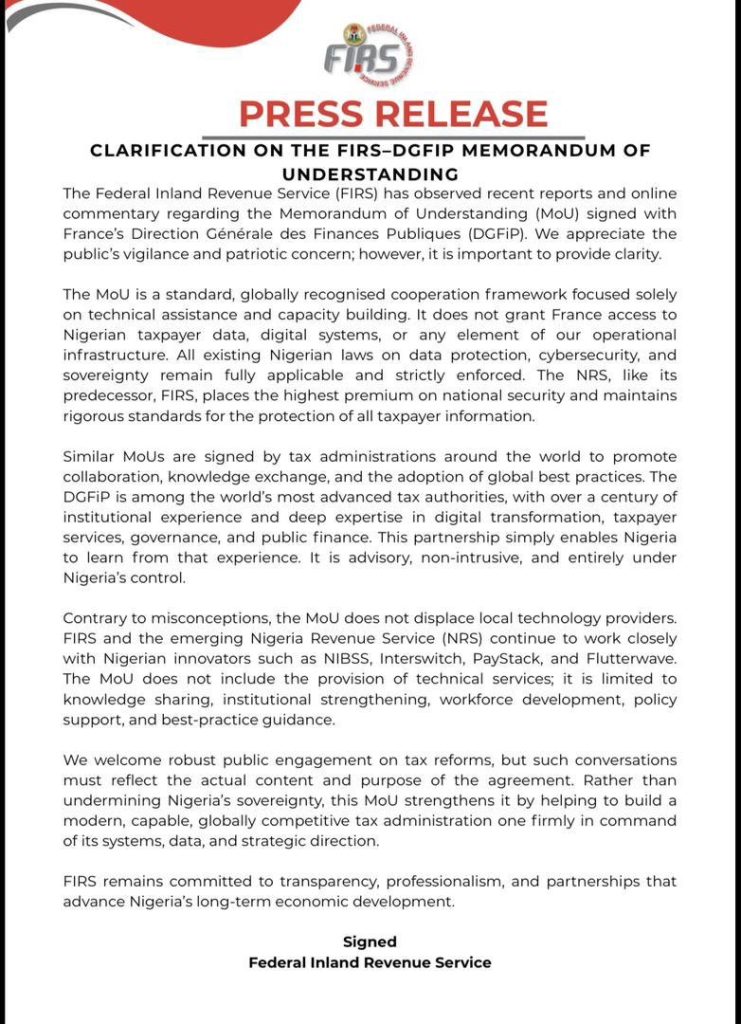

FIRS has firmly rejected these claims. In multiple statements, the agency clarified that:

- no Nigerian taxpayer data will be shared

- France will access no digital systems or infrastructure

- all Nigerian data protection, cybersecurity, and sovereignty laws remain fully in force.

The agency stressed that the MoU is advisory and non-intrusive, limited to knowledge sharing, institutional strengthening, and workforce development. It also noted that similar agreements are standard among tax authorities globally.

FIRS further emphasised that Nigerian technology partners (NIBSS, Interswitch, Paystack, and Flutterwave) remain central to its digital strategy.

Why Does This Matter?

As cross-border trade, digital commerce, and multinational tax planning grow more complex, Nigeria faces pressure to modernise its tax systems without surrendering control.

Supporters argue the partnership positions FIRS to improve efficiency and compliance but critics insist transparency and oversight must follow or else it’s tantamount to exposing Nigerians financial data.