Hollywood’s biggest streaming war just took a decisive turn, and Netflix may have landed the knockout punch. The Netflix Warner Bros Discovery deal might have the last laugh here.

Warner Bros. Discovery has officially rejected Paramount’s $108.4 billion hostile takeover bid, reaffirming its commitment to Netflix’s $82.7 billion deal to acquire Warner Bros studios and HBO. For Paramount, it’s another door slammed shut. For Netflix, it’s a public vote of confidence. While for viewers in Nigeria and across Africa, the ripple effects could be massive.

READ ALSO: Netflix Just Bought Warner Bros — What the $82.7B Deal Means for Movie Lovers Across Africa

Why Warner Bros Chose Netflix (Again)

On paper, Paramount’s offer looked richer: $30 per share, all cash, and a full-company takeover including CNN, TNT, and Discovery channels. But Warner Bros’ board wasn’t buying it, literally.

In a sharply worded filing, the board described Paramount’s bid as risky, opaque, and poorly backed, raising concerns about financing through a revocable trust and the lack of firm Ellison family guarantees. The Netflix Warner Bros Discovery deal, by contrast, was described as fully funded, clearer, and more certain, complete with hefty break-up fees that signal commitment.

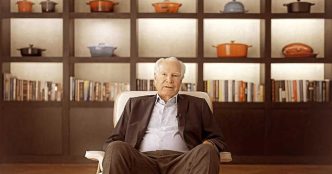

To drive the point home, Netflix co-CEOs Ted Sarandos and Greg Peters showed up at the Warner Bros studio lot, toured the premises with CEO David Zaslav, and addressed staff. That’s a subtle but powerful “we’re already family” message.

READ ALSO: Netflix vs Paramount: Who’s Winning the Battle for Warner Bros?

What is Netflix Buying?

Netflix isn’t acquiring all of Warner Bros. Discovery. It’s buying the crown jewels, which are:

- Warner Bros studios,

- HBO,

- HBO Max, and

- the iconic film and TV library. From Harry Potter and The Dark Knight to Friends, Succession, and The Last of Us.

The cable networks (CNN, Discovery, TNT) are expected to be spun off into a separate company, meaning Netflix doubles down on streaming dominance rather than legacy TV.

Why the Netflix Warner Bros Discovery Deal Matters for Africa

For African viewers, this isn’t just Wall Street drama. Netflix already has a stronger infrastructure across Africa: mobile plans, local payment options, and regional originals. If the deal closes in 2026, HBO and Warner titles could arrive faster, cheaper, and with fewer regional blackouts, especially as DStv prepares to lose 12 Warner-owned channels.

This Netflix Warner Bros Discovery deal will mean less platform-hopping and fewer “not available in your region” errors. Africans will get more content in one place.

But, Is the War Over?

Not quite as Paramount can still try to win over shareholders directly before January 8, 2026. Regulators also loom large, with antitrust and political scrutiny already heating up. But right now, momentum is firmly on Netflix’s side.

For African audiences, the hope is simple: bigger libraries, faster access, and fewer leftovers. Whether Netflix delivers on that promise, without higher prices or tighter control, is the real sequel everyone’s waiting for