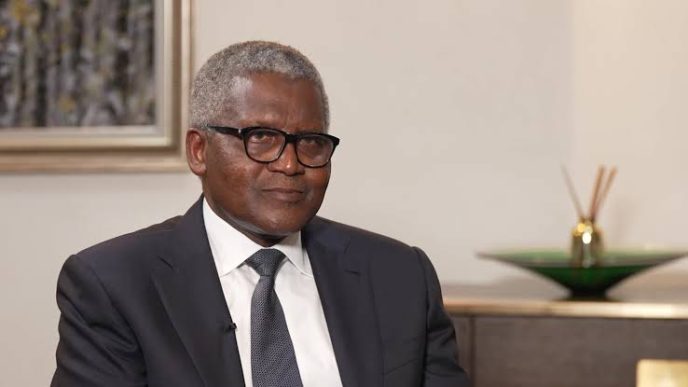

In 1997, at 34, Tony Elumelu did something most ambitious bankers wouldn’t dare. Leading a group of investors, they acquired an insolvent, distressed Crystal Bank Limited, renamed it Standard Trust Bank, and he became CEO.

Nigeria’s banking sector at the time was chaotic. The liberalisation in the 1990s had produced over 100 banks. Capital requirements were relatively low, competition was brutal, and many institutions were weak. Crystal Bank was one of them.

But, unlike anyone else, Elumelu didn’t see a dying bank. He saw a huge prospect simply held back by managerial limitations.

DID YOU MISS: 7 Interesting Facts About Awele Elumelu as She Becomes Transcorp Hotels Board Chair

The 12-Month Rise That Prepared Him

Long before that acquisition, Tony Elumelu’s growth already defied expectations. Graduating with a 2:2 in Economics, he joined Allstates Trust Bank and rose to branch manager in just 12 months. Career analysts will call this pace a sign of unusual drive and commercial instinct.

He later completed a Master’s degree in Economics, deepening a lifelong curiosity about what makes economies work.

“I have always been interested in business and in what makes economies of nations work,” he once said. That intellectual curiosity would later shape both his banking strategy and his development philosophy.

The Crystal Bank Gamble

When he led the acquisition of Crystal Bank in 1997, he became the youngest CEO of a Nigerian bank. The institution was fragile with low confidence and nervous depositors.

He proposed a bold debt-for-equity swap solution. He moved to stop allowing large depositors to withdraw funds and worsen liquidity pressure. Instead, he asked them to convert deposits into equity in the new entity, Standard Trust Bank (STB).

It was a high-trust move requiring credibility, persuasion, and vision. But it worked.

In the next seven months, STB began stabilising, and performance metrics improved exponentially. Over the next few years, the bank grew in bounds, positioning itself as one of Nigeria’s fastest-growing and most disciplined banks.

More importantly, Tony Elumelu demonstrated his visionary management in volatile environments. This proved more valuable than capital.

The 2005 Tony Elumelu Masterstroke that Became UBA Today

By 2004, Nigeria’s banking terrain was about to change. Consolidation reforms under Central Bank Governor Charles Soludo increased minimum capital requirements significantly. This move meant that many banks would disappear.

In his trademark dogged style, Tony Elumelu didn’t resist the wave. He made a move to scale from it.

One year later, in 2005, STB merged with United Bank for Africa (UBA), one of Nigeria’s older-generation banks. The merger was strategic. With STB, the merger got agility, youth, and operational efficiency. With UBA, there was institutional depth and legacy.

The fusion created a new, modern, ambitious, and expansion-driven kind of bank.

From there, UBA embarked on a pan-African expansion strategy. The bank built a presence across multiple African countries and extended into global financial centres. The vision for UBA was to take African banks from just surviving domestically to competing across the continent.

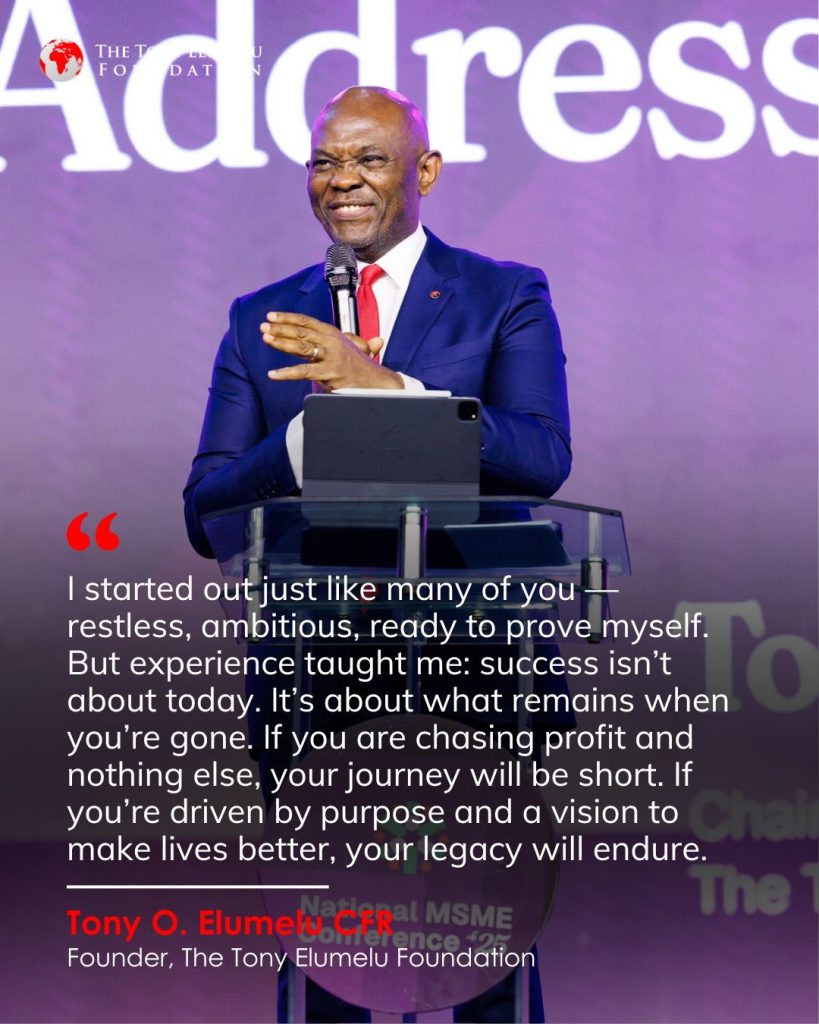

Creating 10,000 More Tony Elumelus

With the Tony Elumelu Foundation (TEF) and the Tony Elumelu Entrepreneurship Programme (TEEP), this industry disruptor is committed to replicating his legacy in more Africans. He’s done this by supporting 1,000 African entrepreneurs annually and has a goal of empowering 10,000 in 10 years.

The idea for him is that if entrepreneurship transformed his life, it can transform Africa at scale.

The programme combines seed capital, training, and mentorship. These are the very elements he credits for his own rise. He often highlights the importance of a “safe and conducive environment” for young people to explore ideas, alongside strong mentorship.

His own mentors played a pivotal role in shaping his early career. TEEP institutionalises that advantage for thousands.

ALSO READ: Tony Elumelu Loses Father-in-law, Chief Israel Ogbue

The Personal Core Behind the Elumelu Empire

Despite the scale of his ventures, Tony Elumelu describes himself first as “very family-oriented” and deeply shaped by his Nigerian and African upbringing. Born, bred, and educated entirely in Africa, he sees his journey as proof that global success does not require relocation.

His formula for success is a resolute drive, discipline, meticulous attention to detail, and faith. This explains how, at 34, he acquired a failing bank. By his 40s, he had engineered one of Africa’s most consequential banking mergers.

Today, Tony Elumelu’s legacy stretches beyond corporate work and boring balance sheets into a change-driven ideology and institution-building.

Tony Elumelu did more than turn around a distressed bank. He created a playbook for African economic power and is continually inviting a generation to follow it.